We pursue a sustainable growth strategy aimed at creating value for all stakeholders. We strive for operational excellence, product innovation and sustainability as key tools to continue to grow and generate value over time.

The 2026-2028 Industrial Plan

The 2026-2028 Industrial Plan, presented to our shareholders on 12 February 2026, by placing ESG at the heart of our strategy, leverages on five strategic priorities: sustainability, valuing people, innovation, improve competitiveness, growth & positioning.

Our decarbonization path

Cementir has renewed its commitment to sustainability by updating its 2030 decarbonization Roadmap. Over the 2026–2028 period, the Group expects to invest approximately EUR 77 million in sustainability projects, including: the installation of wind turbines in Belgium, upgrades to FUTURECEM® production facilities, the transition to natural gas at plants in Denmark and Belgium, increased use of alternative fuels in Türkiye and their introduction in Malaysia and China, as well as feasibility studies for a CO₂‑capture project in Belgium. The capex for the ACCSION project (CCS in Denmark) has been included in the Industrial Plan for EUR 16 million in 2026.

77 million sustainability investments in the three years CO2 reduction target of 42% in grey cement and 20% in white cement by 2030 (vs 2020 baseline) | |||

| Carbon Capture and Storage (CCS) | Reduction of clinker content in cements | Alternative fuels and energy | Operating efficiencies and Circular economy |

|

|

|

|

2026-2028 Industrial Plan strategic priorities

-

Sustainability and target of CO₂ emissions reduction by 2030

Cementir reaffirmed its commitment to achieving net‑zero emissions by 2050 and updated its 2030 Roadmap, which outlines sustainability targets aligned with the United Nations Sustainable Development Goals. These targets are integrated into the management incentive system and cascaded across every production site.

In grey cement, the Group aims to reduce gross Scope 1 emissions to 418 kg of CO₂ per ton by 2030 (‑42% compared to 2020), a level below the threshold set by the European Taxonomy (460 kg/ton). For white cement — a niche product used in specific applications — the 2030 target is 730 kg of CO₂ per ton, representing a 20% reduction versus 2020.

Key levers to achieve these targets include reducing the clinker content in cement; developing low‑carbon cements such as FUTURECEM® and D‑Carb®; and expanding blended cements based on supplementary cementitious materials such as fly ash, pozzolana and slag. Additional drivers include the increasing use of alternative fuels and alternative energy sources, optimisation of thermal efficiency, and the recycling and reuse of materials.

A key element of the decarbonisation plan is the implementation of carbon capture and storage (CCS) technology in Aalborg, Denmark, through the ACCSION project — Cementir’s first CCS initiative and one of the largest onshore carbon capture and storage systems in Europe — which will become operational in 2030. Once fully operational, it is expected to reduce CO₂ emissions by approximately 1.5 million tons per year.

On indirect Scope 2 emissions, the Group has initiated a progressive decarbonisation plan for energy procurement to increase the use of renewable electricity, through long‑term power purchase agreements (PPAs) as well as wind and/or solar installations at its sites.

Regarding Scope 3, Cementir is strengthening engagement across its supply chain, promoting the integration of carbon‑footprint criteria into supplier selection and qualification processes, and encouraging lower‑impact solutions in the most significant purchasing categories, including initiatives in transport and logistics.

Over the 2026–2028 period, the Group expects to invest approximately EUR 77 million in sustainability projects, including: the installation of wind turbines in Belgium, upgrades to FUTURECEM® production facilities, the transition to natural gas at plants in Denmark and Belgium, increased use of alternative fuels in Türkiye and their introduction in Malaysia and China, as well as feasibility studies for a CO₂‑capture project in Belgium.

The capex for the ACCSION project (CCS in Denmark) has been included in the Industrial Plan for EUR 16 million in 2026.

-

Valuing People

The Group promotes a strong safety culture, with a ‘Zero Accidents’ objective, through dedicated training and awareness programs for its employees. Cementir prioritises human capital development and the creation of an inclusive working environment that values diversity, skills, and individual potential.

Key people development initiatives include the Cementir Academy, managerial development programmes, continuous training, and performance management systems. The Group also strengthens global identity and integration by enhancing the sense of belonging to the One Group through employer‑branding activities and tools such as the people survey. At the same time, Cementir continues to improve organisational effectiveness and operational agility, supporting a structure that is increasingly responsive, efficient, and results‑oriented.

-

Innovation

The Group is strongly committed to product innovation, with the goal of developing low‑impact solutions, new low‑carbon cements, and other high value‑added sustainable products such as FUTURECEM®, which reduces the clinker content in cement and therefore lowers CO₂ emissions by around 30%, and D‑Carb® for white cement. The Group promotes low‑carbon cements and ready‑mix concrete equipped with Environmental Product Declarations (EPDs) verified by accredited certification bodies. It also aims to increase the share of sustainable products, including recycled concrete and aggregates, supporting a circular‑economy model.

Through the adoption of digital technologies — including artificial‑intelligence solutions across production, commercial activities and the supply chain — the Group aims to further enhance operational efficiency, improve customer experience, and accelerate digitalisation.

-

Competitiveness

The Group is continuing to implement a series of initiatives to further enhance profitability and operational excellence, including process digitalisation, preventive and predictive maintenance, advanced production‑control systems, smart logistics, warehouse optimisation, and integrated digital sales planning. These measures aim to streamline operations, reduce costs, and strengthen the Group’s overall competitiveness.

-

Growth and positioning

Cementir continues to combine organic growth, strategic acquisitions and targeted investments in key markets. The Group is strengthening vertical integration and its competitive positioning in the Nordic & Baltic, Belgium and Türkiye regions through bolt‑on acquisitions and the rationalisation of its production footprint. It is also further consolidating its global leadership in white cement through targeted actions in strategic markets. The solid financial position enables the Group to assess additional external growth opportunities in its core business.

Performance and Industrial Plan targets

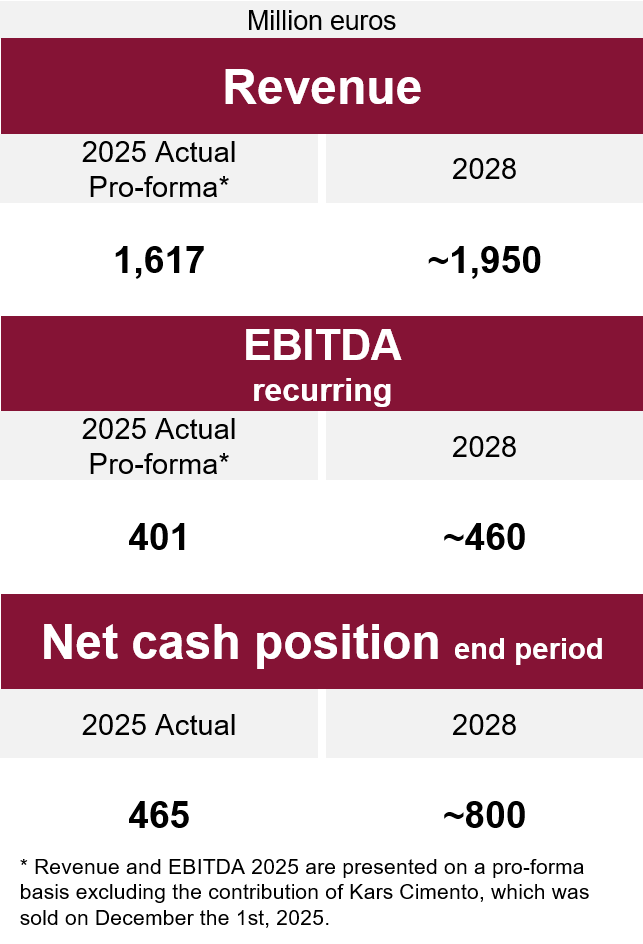

The Plan envisages the achievement of the following 2028 targets, which exclude IAS 29 impact and non-recurring items:

- Revenue of approximately EUR 1.95 billion in 2028, with an average annual growth rate (CAGR) of 6–7% compared to 2025. The Plan incorporates moderate growth in cement sales volumes, supported by the solid performance of the Nordic & Baltic area—where a recovery in the residential segment is expected starting in 2027—by increased exports from Egypt, and by the positive trend in Belgium, China, and Malaysia, although with differing growth rates.

This growth is partially offset by a decline in domestic volumes in Türkiye in 2026, due to the completion of post‑earthquake housing projects and the disposal of the Kars plant. For ready‑mixed concrete and aggregates, a substantially stable or slightly growing trend is expected over the three‑year period.

Price evolution is expected to remain in line with local inflation, particularly in Türkiye, to reflect the increase in energy, raw material, and CO₂ costs. - Recurring EBITDA of approximately EUR 460 million in 2028, with an average annual growth rate (CAGR) of 4.7% compared to pro-forma 2025. A positive performance is expected in most geographical areas, particularly Nordic & Baltic, Belgium, Asia Pacific, Egypt and trading activities, while a reduction in Türkiye’s contribution is anticipated, especially in 2026.

Key assumptions include: higher raw material costs, electricity and certain fuels; a negative impact from currency volatility, particularly the Turkish lira and the Egyptian pound; an average annual CO₂ deficit of around 130,000 tons, rising in 2027 due to the reduction of free allowances at European plants. The EBITDA margin is expected to remain slightly below the 2023–2025 average. - Over the 2026–2028 Plan period, investments of approximately EUR 386 million are planned, of which EUR 77 million refer to sustainability initiatives aimed at reducing CO₂ emissions in line with the Group’s objectives.

The investment for the ACCSION project has been included in the Industrial Plan for EUR 16 million in 2026. The Group’s net investments related to ACCSION amount to approximately EUR 120 million over the three-year period starting from 2027. The timing of these investments will also be finalized in relation to the development of the CO₂ transportation and storage infrastructure network, which is responsibility of third-party public and private entities. - Net cash position of around EUR 800 million at the end of 2028, resulting from a cumulative cash generation of about EUR 330 million.

Finally, the Plan assumes the distribution of an increasing dividend, corresponding to a payout ratio between 20% and 25%.

* Revenue and EBITDA for 2025 are presented on a pro‑forma basis excluding the contribution of Kars Cimento, which was sold on December the 1st, 2025.

Industrial Plan 2026-2028 main targets